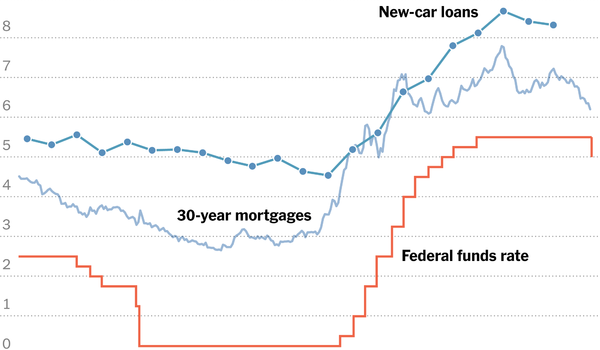

The recent decision by the Federal Reserve to lower interest rates by 0.5%, or fifty basis points, to a range of 4.75% to 5.0% at its September meeting is anticipated to ignite a mortgage refinance demand surge. Homeowners are expected to seize the opportunity to refinance their mortgages to consolidate high-interest debts, manage jumbo loans with significantly higher interest rates, or transition from adjustable-rate mortgages to more stable, fixed-rate options. This presents a prime opportunity for mortgage lenders and brokers to enhance their customer retention strategies and attract new clients amidst this evolving economic situation.

Refinancing a mortgage serves as a strategic financial move, enabling customers to secure lower monthly payments and offering flexibility in terms of loan type and duration. Additionally, a cash-out refinance option allows homeowners to tap into their home equity, converting it into cash that can be used for various purposes such as home renovations or settling high-interest debts from credit cards or student loans.

As mortgage rates continue to decline from their peak of 7.39% in May, the current average 30-year fixed refinance interest rate stands at 6.28%, marking a four basis point reduction from the previous week, as reported by Bankrate.com. This trend highlights a favorable environment for refinancing, presenting mortgage brokers and lenders with an opportunity to engage with potential refinancers.

To capitalize on this burgeoning demand, mortgage lenders should focus on reinventing their lending acquisition and retention strategies.

Leverage DataVue’s PrecisionPulse Triggers for Enhanced Customer Retention

In the current climate of increased mortgage refinance activity, staying ahead of the competition is paramount for mortgage lenders. This is where DataVue’s PrecisionPulse Triggers become an invaluable tool. By providing daily alerts on customer-initiated soft inquiries and prequalifications, these triggers inform lenders when a customer is considering refinancing their mortgage and potentially turning to another lender. This timely information is crucial for mortgage lenders who prioritize customer retention as a key driver of business growth.

Partnering with DataVue offers several compelling benefits:

- Enhance Retention with More Insight on Your Customers’ Credit Needs: By understanding the specific credit needs and interests of your customers, you can tailor your offerings to better meet their expectations, strengthening the relationship and encouraging loyalty.

- Inform Outreach Efforts and Boost Relationship Management: With precise data on customer behavior, lenders can craft more informed and targeted outreach strategies, ensuring that communication is relevant and timely, which is vital for maintaining strong customer relationships.

- Understand Which Credit Products Your Customers Are Interested In: Triggers provide a window into the credit products that capture your customers’ interest, allowing you to adjust your product offerings and marketing strategies accordingly.

- Fuel Retention Efforts and Reduce Churn: By staying informed about your customers’ refinancing intentions, you can proactively address their needs, reducing the likelihood of them switching to a competitor and thus minimizing churn.

Incorporating DataVue’s PrecisionPulse Triggers into your business strategy not only keeps you one step ahead of your competitors but also empowers you to build enduring client relationships by responding promptly to their refinancing needs. This proactive approach ensures that your retention efforts are robust and your market presence continues to grow.

Highlight the Net Benefit: Demonstrating Clear Financial Advantages

One of the primary factors influencing a borrower’s decision to refinance is the net benefit they will receive from the transaction. Borrowers are keen to understand how much they will save in terms of monthly payments and over the life of the loan. To stand out, mortgage lenders should focus on clearly communicating these financial advantages.

Strategy: Offer Personalized Savings Analysis Tools

Mortgage lenders can enhance their appeal by providing personalized savings analysis tools that demonstrate the financial impact of refinancing options. These tools should easily calculate potential savings, showing customers a clear comparison between their current mortgage and new loan terms. By offering personalized insights, lenders can build trust and help borrowers make informed decisions, ultimately improving conversion rates.

Elevate Customer Service: Creating a Superior Client Experience

In a competitive market, the quality of customer service can significantly influence a borrower’s choice of lender. Borrowers are more likely to choose lenders who provide not only efficient service but also a supportive and informative customer journey.

Strategy: Implement a Dedicated Refinancing Support Team

Mortgage lenders can differentiate themselves by establishing a dedicated refinancing support team that specializes in guiding borrowers through the refinancing process. This team should be knowledgeable, responsive, and able to provide clear answers to any refinancing queries. Offering a high level of personal service helps to build strong relationships with borrowers, increasing the likelihood of customer loyalty and repeat business.

Competitive Loan Offerings: Expanding Product Choices

Borrowers often seek out lenders who can offer competitive loan products that align with their financial goals. This includes options such as lower interest rates, flexible terms, and innovative refinancing solutions.

Strategy: Develop a Diverse Portfolio of Refinancing Products

Mortgage lenders can capture a larger market share by diversifying their refinancing product offerings. This could include options like adjustable-rate mortgages with initial low rates, loans with no closing costs, or specialized products for unique borrower needs. By expanding their portfolio, lenders can cater to a wider range of borrowers, making it easier for potential clients to find a product that meets their specific refinancing requirements. This strategic variety not only attracts new customers but also helps retain existing ones by offering tailored solutions.

Seizing the Refinance Opportunity: Strategies for Success and Retention

As the mortgage refinance demand is poised to surge with the lowering of interest and mortgage rates, mortgage lenders have a golden opportunity to enhance their market presence and customer base. By focusing on strategies such as clearly highlighting the net benefits of refinancing, elevating customer service through dedicated support teams, and offering a diverse array of competitive loan products, lenders can effectively meet borrower needs and stand out in a competitive landscape. Partnering with DataVue to leverage our PrecisionPulse Trigger further empowers lenders to stay ahead of the competition by providing timely insights into customer refinancing interests, thus boosting retention efforts. Now is the time for mortgage lenders to implement these strategies and fully capitalize on the opportunities presented by this evolving economic dynamic, ensuring their growth and success in the marketplace.