The personal loans market is experiencing a transformational shift fueled by fintech advancements and an increasing demand for accessible lending solutions. Between the expanding role of technology and changing consumer behavior, lenders are navigating an evolving landscape that presents both challenges and tremendous opportunities. Below, we’ll explore key dynamics impacting this market, what the growing demand means for lenders, and how companies like DataVue are empowering lenders to stay ahead of the curve.

The Personal Loans Market’s Expansive Growth

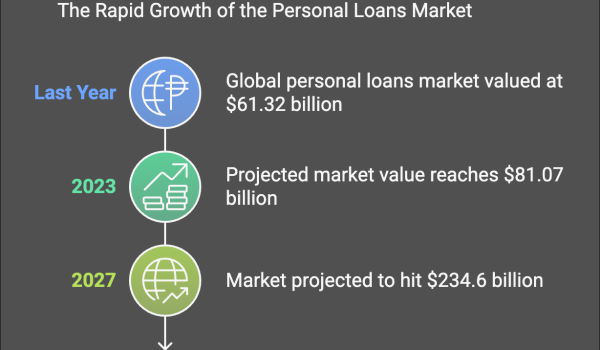

The numbers tell an incredible story of growth. Valued at $61.32 billion last year, the global personal loans market has been projected to reach $81.07 billion in 2023—a 32.2% compound annual growth rate (CAGR). Even more impressively, this upward trajectory is set to propel the market to $234.6 billion by 2027, maintaining an astounding CAGR of 30.4%.

This growth isn’t just about numbers; it reflects a broader shift in consumer behavior and lender strategies. People today rely heavily on personal loans to consolidate debt, fund home renovations, or address unexpected financial challenges. Simultaneously, lenders are leveraging technology, redefining how these loans are delivered. For lenders, keeping pace with this growth means adopting innovative mechanisms to serve a diverse range of borrowers efficiently.

Technology is Redefining Lending

Advancements in technology continue to serve as a powerful catalyst driving the personal loans market forward. Fintech solutions and online loan platforms have redefined the borrowing experience, offering consumers easier access to funds than ever before. Additionally, these cutting-edge technologies are transforming the operations of traditional lending institutions.

Innovative approaches are already making waves in the industry. For instance, UK-based Amplifi Capital recently launched Reevo Money—a personal loan brand focused on borrowers with poor credit or inconsistent income. This highlights how technology enables lenders to serve niche markets that might have been underserved in the past. Similarly, acquisitions like Latitude Financial Group Limited’s integration of Symple showcase how companies are expanding their capabilities to meet modern demands.

For lenders, these technological leaps demonstrate the importance of adaptability. Staying competitive means embracing tools that not only streamline operations but also enable more intelligent decision-making when it comes to loan approvals and targeting.

Why Lending Channels Are Key to Growth

The rise of diverse lending channels represents another significant contributor to the booming personal loans market. Consumers today gravitate toward solutions that offer convenience, customization, and speed. Online lending platforms, peer-to-peer networks, and mobile fintech apps have gained popularity for their ability to meet these expectations.

Recent data from TransUnion reveals that total personal loan balances have reached record highs, underscoring the growing reliance on these lending methods. Borrowers use personal loans for various reasons—whether to manage debt more effectively, handle emergency expenses, or fund personal goals.

For lenders, these trends reaffirm the importance of being present where borrowers are. Prioritizing the development of agile, user-friendly lending platforms ensures they capture a share of the growing demand. The ability to offer personalized options, swift approvals, and transparent processes will continue to set successful lenders apart in this competitive landscape.

What the Growing Demand for Personal Loans Means for Lenders

The relentless growth of the personal loans market translates into immense opportunities for lenders. However, this also means they must evolve to meet the needs of a more informed and selective audience.

Today’s borrowers expect tailored experiences. They want flexibility, fast access to funds, and solutions built around their specific needs. Lenders that fail to meet these expectations risk being left behind.

Additionally, as competition intensifies, differentiating on price alone won’t be enough. The focus will shift toward value-added services—using technology to gain deeper insights into borrower profiles, enhance underwriting accuracy, and expand access to credit responsibly. This growing demand represents an inflection point for lenders, calling on them to not only serve existing markets but also uncover untapped opportunities effectively.

How DataVue is Transforming Lending with Predictive Precision

Staying relevant in the fast-evolving personal loans market requires more than understanding general trends. Lenders need actionable insights that enable them to engage the right borrowers at the right time. This is where DataVue becomes a game-changer.

DataVue blends consumer credit data with advanced machine learning, giving lenders an unmatched ability to identify high-propensity borrowers who are actively in-market for personal loans. Unlike traditional credit metrics that show only a snapshot of a borrower’s financial profile, DataVue’s suite of tools reveals a dynamic, trended view of their financial behavior over time. This means lenders can predict not just who needs a loan today, but who is likely to need one in the near future.

Imagine being able to offer a personalized loan solution to a borrower before they even start shopping around. Through precision targeting, DataVue empowers lenders to craft compelling offers tailored to an individual’s unique needs and circumstances. The result? Higher engagement rates, increased loan approvals, and a lower cost per acquisition.

But that’s not all. DataVue’s predictive analytics also help lenders refine their strategies on a larger scale. By analyzing trends within borrower segments, lenders can uncover new growth opportunities while mitigating risks. From refinancing seekers to first-time applicants, DataVue ensures that your marketing dollars are spent pursuing leads with the greatest potential, maximizing your ROI.

Contact us today for a free consultation call.

Building a Smarter Future for Lending

The personal loans market shows no signs of slowing down, and for lenders, this is both an opportunity and a challenge. Success will depend on the ability to adapt strategies, adopt innovative technologies, and keep borrower-centric practices at the forefront.

Whether enhancing lending platforms, investing in data-driven insights, or streamlining operations, lenders must recognize the importance of staying reactive to market shifts. Tools like DataVue are paving the way for a smarter, more efficient future in lending—one where data and analytics transform how lenders connect with borrowers and meet their evolving needs.

By leveraging such advancements, lenders can not only keep pace with the growing market but also lead in crafting meaningful financial solutions. This isn’t just about doing better business—it’s about creating impactful lending experiences that drive trust, loyalty, and long-term value for all stakeholders involved.

By structuring efforts around innovation and consumer insight, lenders are well-positioned to thrive in this rapidly growing market. Keeping an eye on emerging trends and partnering with technology-driven solutions like DataVue will ensure you stay ahead of the competition while delivering results that matter. It’s not just about capturing growth—it’s about shaping the future of personal lending.